The origins of the Indian cement industry can be traced back to 1914 when the first

unit was set-up at Porbandar with a capacity of 1000 tonnes. Today India has 142

large cement plants and more than 360 mini cement plants. However, the industry

is dominated by around 20 companies, which account for almost 70% of the total cement

production.

Technology Up-gradation:

Technological upgrades involving more efficient and cleaner technologies acquired

by the Indian cement industry in the past few years has brought in capability to

produce different types of cement like Ordinary Portland Cement (OPC), Portland

Pozzolana Cement (PPC), Portland Blast Furnace Slag Cement (PBFS), Oil Well Cement,

Rapid Hardening Portland Cement, Sulphate Resisting Portland Cement, Clinker Cement,

White Cement, Low heat cement, High early strength cement, Hydrophobic cement, High

aluminium cement, Masonry cement etc.

Currently, over 90% of the total installed capacity is based entirely on the modern

and environment-friendly dry process technology. Co-generation of power utilizing

waste heat is an added advantage of introduction of new technology which has resulted

in substantial savings of energy and fuel for this highly energy intensive industry.

Cement Industry, which was branded as the highest polluter of environment, now meets

the pollution standards, and is no longer a polluter today. It contributes to environmental

cleanliness by consuming hazardous wastes like Fly Ash (around 30 MT) from Thermal

Power Plants and the entire 8 MT of Slag produced by Steel manufacturing units every

year.

Business scenario:

Cement is a commodity business and sales volumes mostly depend upon the quality

perception and distribution reach of the company. There is intense competition with

players cashing in on quality and expanding reach to achieve pan India presence.

The per capita consumption of cement in India is approximately 60% below the world

average and is almost 7 times lower than that of China. This underlines the tremendous

scope for growth in the Indian cement industry in the long term.

Owing to the fast pace of economic reforms and a major thrust from the government

on the infrastructure sector, the real estate sector is booming and there is a flurry

of activities in infrastructure development such as the emerging trend of building

concrete roads, expansion of the state and national highways as well as projects

to build reliable Transport Systems like the Mass Rapid Transport Systems in all

major metro cities. All this is leading to tremendous growth in the cement industry.

The Industry recorded an exponential growth with the introduction of partial decontrol

in 1982 culminating in total decontrol in 1989. The push in cement demand during

the last fiscal was attributed to revival of infrastructure and real estate projects.

The central government has earmarked US$ 47 billion for infrastructure development

during fiscal 2011-12. This thrust on infrastructure will keep the long term demand

for cement intact.

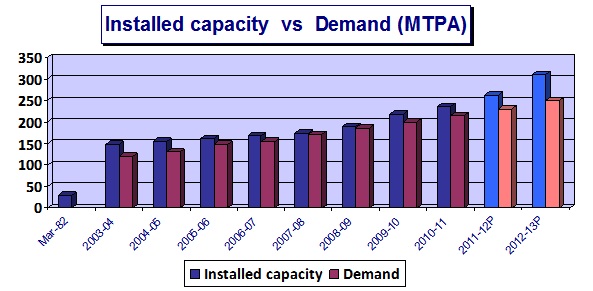

Demand-Supply scenario:

Today, India is ranked second among the world cement producing countries. The Indian

cement industry has clocked production of more than 100 MT for the last five years,

registering a growth of nearly 9% to 10% year on year.

The total cement production for Apr-Jan 2010-11 was 137 MT as compared to 131 MT

during the corresponding period of the previous fiscal.

Globalization:

Cement and gypsum products have received cumulative foreign direct investment (FDI)

of US$ 2,315.58 million between April 2000 and January 2011, according to the Department

of Industrial Policy and Promotion (DIPP).

Top cement companies of the world are vying to enter the Indian market, thereby

sparking off a spate of mergers and acquisitions.

Among the domestic players, Gujarat Ambuja taking over DLF Cements & Modi Cement

and acquiring 14% stake in ACC; ACC taking over IDCOL; India Cement taking over

Raasi Cement and Sri Vishnu Cement; and Grasim's acquisition of the cement business

of L&T, Indian Rayon's cement division, and Sri Digvijay Cements, are some examples

of consolidation in the Indian cement industry.

Given the high potential for growth, foreign cement companies are picking up stakes

in large Indian cement companies. Swiss cement major Holcim has picked up 14.8 %

in Gujarat Ambuja Cements (GACL) leading to the formation of Holcim-ACC-Gujarat

Ambuja Cements combine. The other leading player is the Aditya Birla group combine

through Grasim Industries and Ultratech Cement. Lafarge, the French cement major

has acquired the cement plants of Raymond and Tisco. Italy based Italcementi has

acquired a stake in the K.K. Birla promoted Zuari Industries cement plant in Andhra

Pradesh, and Heidelberg Cement of Germany has entered into an equal joint-venture

agreement with S.P.Lohia Group controlled Indo-Rama Cement.

Issues concerning Cement Industry:

Cement, being a bulk commodity, freight accounts for over 17% of the costs, and

transportation over long distances can prove to be uneconomical. Availability of

limestone, availability and quality of coal, licensing of coal and limestone reserves,

supply of power from the state grid and high government levies on cement are the

main cause of concern for the industry. Added to this, the high levels of capital

investments needed for capacity expansion, modernization and up gradation of the

cement industry have long gestation periods.

However, given the sustained growth in the real estate sector, the government's

emphasis on infrastructure and increased global demand, it looks as if the juggernaut

of cement industry would continue to roll on the path of growth.

Role of ERP in Cement Industry:

Oracle Enterprise Resource Planning (ERP) software provides a companywide business

visibility interlinking all functional areas such as sales and distribution, manufacturing,

purchasing, inventory, finance & accounts, human resource development etc. and works

on a unified Customer database and a single Supplier database for the entire company.

It is designed to work based on the best business practices prevalent in the industry

the world over.

Data security is addressed thru a comprehensive portfolio of security solutions

deployed by Oracle and using privileged user access controls provided thru system

administrator.

Details are available at:

Oracle Database Security

All major business processes practiced in the industry can be mapped in Oracle ERP.

The entire cement manufacturing process starting from raw material preparation,

clinker production and finish grinding of clinker can be mapped in the Oracle Process

Manufacturing (OPM) module of the Oracle ERP system. It works seamlessly integrated

with the other modules such as OPM Product Development, OPM Process Planning, Oracle

Purchasing, OPM Inventory, Oracle OPM Costing, OPM Order Management, and OPM Financials

of the Oracle E-Business Suite.

Design formulation: Simulations can be performed in Oracle ERP to

create new Formulations and Recipes or to revise existing ones, in line with engineering

changes. Accuracy is maintained since these can be created or edited by Formulator

only.

Planning: Oracle Flow Manufacturing, Oracle Order Management & Shipping

Execution and Oracle FinancialsBased on the Sales demand and existing recipes, ORACLE

ERP plans purchases of ingredients and other input materials (material planning)

and also performs scheduling of production orders thru resource capacity planning.

Purchasing & Inventory: Purchase Orders are approved as per predetermined

hierarchy and history tracking is maintained. As and when material is received from

Supplier in the ERP system against the relevant order, inventory stocks are updated

for the respective item. Simultaneously, excise registers are updated and / or MODVAT

claim process is completed in the system automatically.

Production: Batches are created against scheduled production orders.

Inventory stocks of Purchased Items, Work-In-Process items and Finished Goods get

updated automatically in the software based on Batch completion (production booking)

done.

Maintenance: Assets are maintained thru a Manual work order or thru

a Preventive Maintenance Schedule (PMS) which automatically generates Preventive

Maintenance Work Orders as well as Material Requirements for the required spare

parts. Based on completion status of such Work Orders, Maintenance Cost is calculated

by the Oracle ERP software.

Quality: Data capture and traceability of Batch / Lot quality right

from input material to finished goods is taken care of by the software.

Invoicing: Finished Goods are invoiced and dispatch documents generated

using the software thus keeping a record of each dispatch against the related Sales

Order.

Sales & Marketing: Besides booking Sales Orders and getting real time

updates on dispatch status of orders booked earlier, the sales team can take informed

decisions on prospective sales orders or formulation of sales strategies sitting

in their respective sales office / regional office / corporate office, based on

the real time stock status of finished goods and estimated date of dispatch of goods

planned for manufacturing.

Excise & Taxation: Excise registers are automatically maintained and

available for on-line review. Sales Tax claims / returns can be filed based on the

system records.

Finance & Accounts: Apart from routine financial transactions such

as receipts from customers, payments to suppliers and cash flow management, financial

books can be maintained and financial reporting can be done efficiently. Product

cost sheets are maintained on-line. Period closing activity in Oracle ERP enforces

system discipline thru periodic inventory and account reconciliations, thus minimizing

major gaps at a later stage. Statutory audits, Tax audits and Cost audits can be

done on-line.

In addition to providing a user-friendly environment, the Oracle ERP software can

be tailored to incorporate specific needs of companies both large and small, progressively

expanded, in the ‘horizontal’ sense to embrace additional organizational functions,

as well as ‘vertically’ to integrate other stages of the production process.

On account of its modular structure, the ORACLE ERP software can cater to cement

industries of all kinds, from vertically integrated companies to those specializing

in single stage of the production process.

On the whole, ORACLE ERP helps to drive the entire organization on a single platform,

provides an improved supply-demand linkage with remote locations, enables informed

management decisions based on real time access to accurate data, and enables cutting

down of material and resource wastages thru effective utilization as well as thru

reduction of communication gaps and paperwork.

For its clients in the Cement industry, the ERP solution package which Filix recommends

includes the relevant Oracle E-Business Suite (Release 12) modules namely, OPM Product

Development, OPM Process Planning, Oracle Purchasing, OPM Process Execution, OPM

Quality, OPM Inventory Control, Oracle Order Management, OPM Logistics, Oracle Enterprise

Asset Management and Oracle OPM Financials.

The main components of this packaged solution are:

- Product Development - Formula, Recipe & Laboratory Management

- Process Planning - Raw material planning & Production scheduling

- Purchasing - Formula, Recipe & Laboratory Management

- Process Execution - Production Management & Process Operations Control

- Quality management

- Inventory management

- Enterprise Asset Management - Breakdown & Preventive Maintenance

- Order Management - Sales & Marketing

- Logistics - Dispatch

- Financials - Account Payables, Account Receivables, Process costing & Manufacturing

Accounting Controls, Cash Management, Fixed Assets & General Ledger

Additionally, on need basis, clients can also opt for Oracle Transportation Management,

Oracle iSupplier Portal, Oracle HRMS and Oracle Business Intelligence products.

Filix has wide ranging experience from end-to-end implementation to post-implementation

support in the Indian Cement industry. Clients utilizing Filix services benefit

from our knowledge base and rich experience in implementing all the above mentioned

modules, mapping of the client business processes with the standard Oracle product

functionality as well as from Filix expertise in development of Customized forms

and reports.

Users of Oracle Financials at these clients benefit from this core strength of Filix

team. This includes, to name a few, handling of complex India localization and taxation

scenarios of Service Tax and TDS, Budgeting, Fixed Asset depreciation scenarios

and making the users comfortable in using the Oracle Financial Statement Generator

to analyze the financial data such as expense, income, taxes, inventory and project

wise expenses.

Customized Reports like Item Cost Report, Material Flow report for OPM Inventory,

Material Consumption report for OPM Inventory, Certificate of Analysis, AP to GL

Reconciliation Report, AR vs COGS Reconciliation Report, Receipt/Purchase Register,

Sales Register, are only a few out of the list of reports developed to suit specific

needs of our clients from the Cement process industry.

With its custom-built products which integrate seamlessly with the Oracle E-Business

Suite application, Filix has deployed its technical expertise to map typical business

processes being practiced at clients.

With its custom-built products which integrate seamlessly with the Oracle E-Business

Suite application, Filix has deployed its technical expertise to map typical business

processes being practiced at clients.

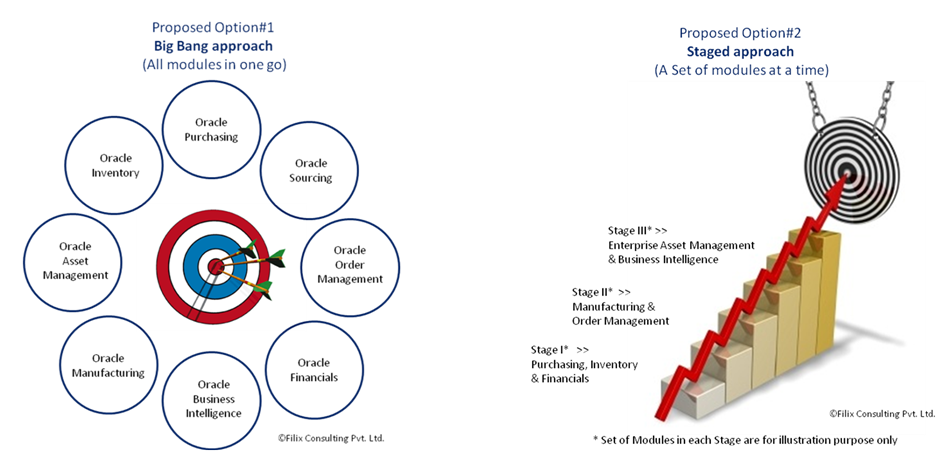

Implementation approach:

Filix services are available for the ‘big-bang approach’ as well as for the ‘staged

approach’ for ORACLE ERP implementation, based on client’s business needs. However,

Filix recommends the 'staged approach' for its prospective clients in the Cement

sector in India. This approach helps to get the basic business processes (Purchasing,

Inventory Management, Manufacturing and Finance) mapped and working in ORACLE ERP

before moving on to utilize the larger benefits such as Business intelligence etc.